While it is free to dream of a luxurious lifestyle, it is often too difficult to make it possible. Turning dreams into reality after all takes a lot of money and without having enough in my pocket or savings account, my dream lifestyle would certainly stay as it is.

Fortunately nowadays, there are fast-growing financing institutions that provide financial solutions to cater to the needs of Filipinos. These include the Banco De Oro, commonly known as BDO, which has been designed to generate help for money savers and further operates for individuals who are in dire need of funds to start up a business or simply fulfill their everyday goals.

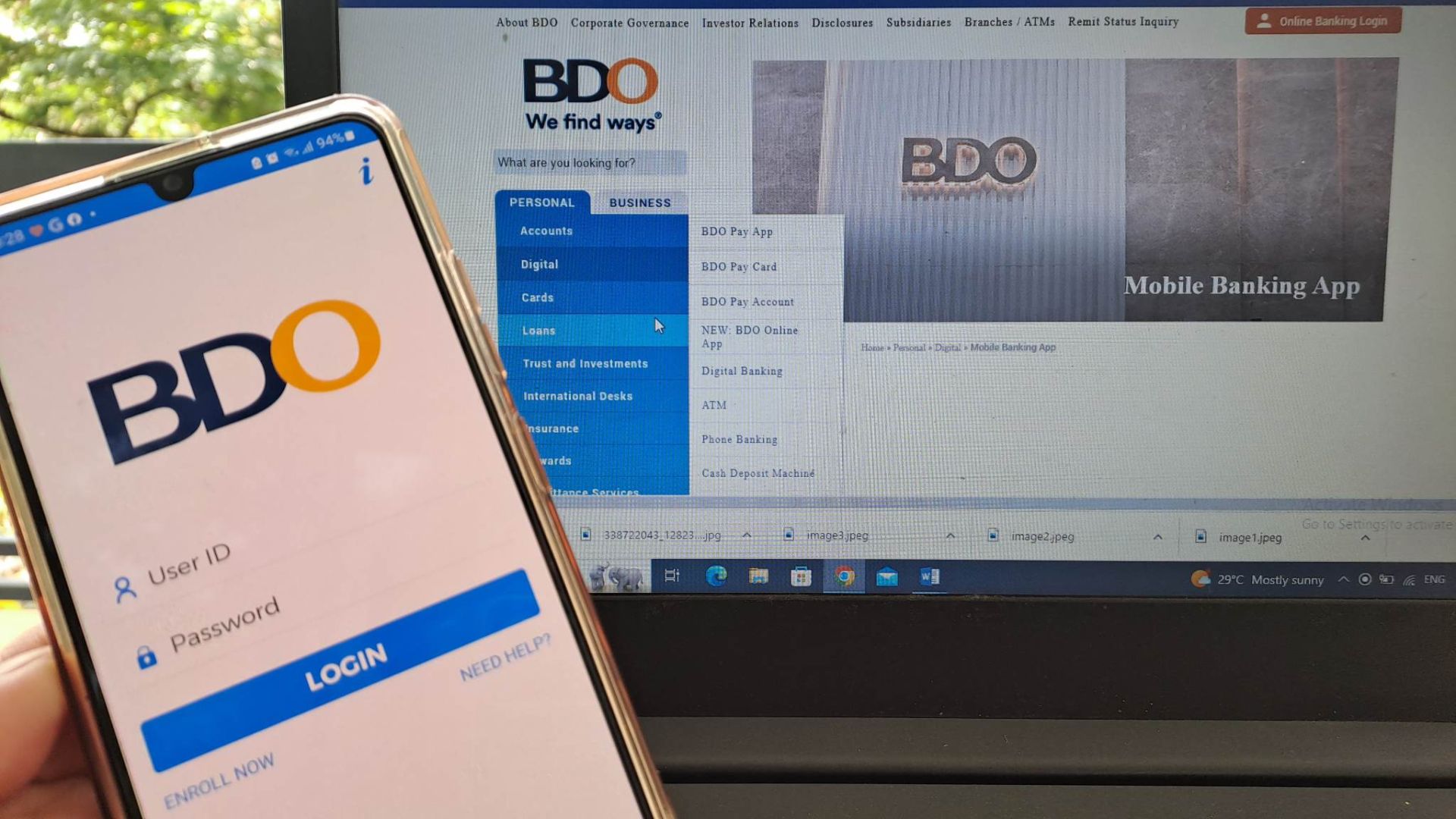

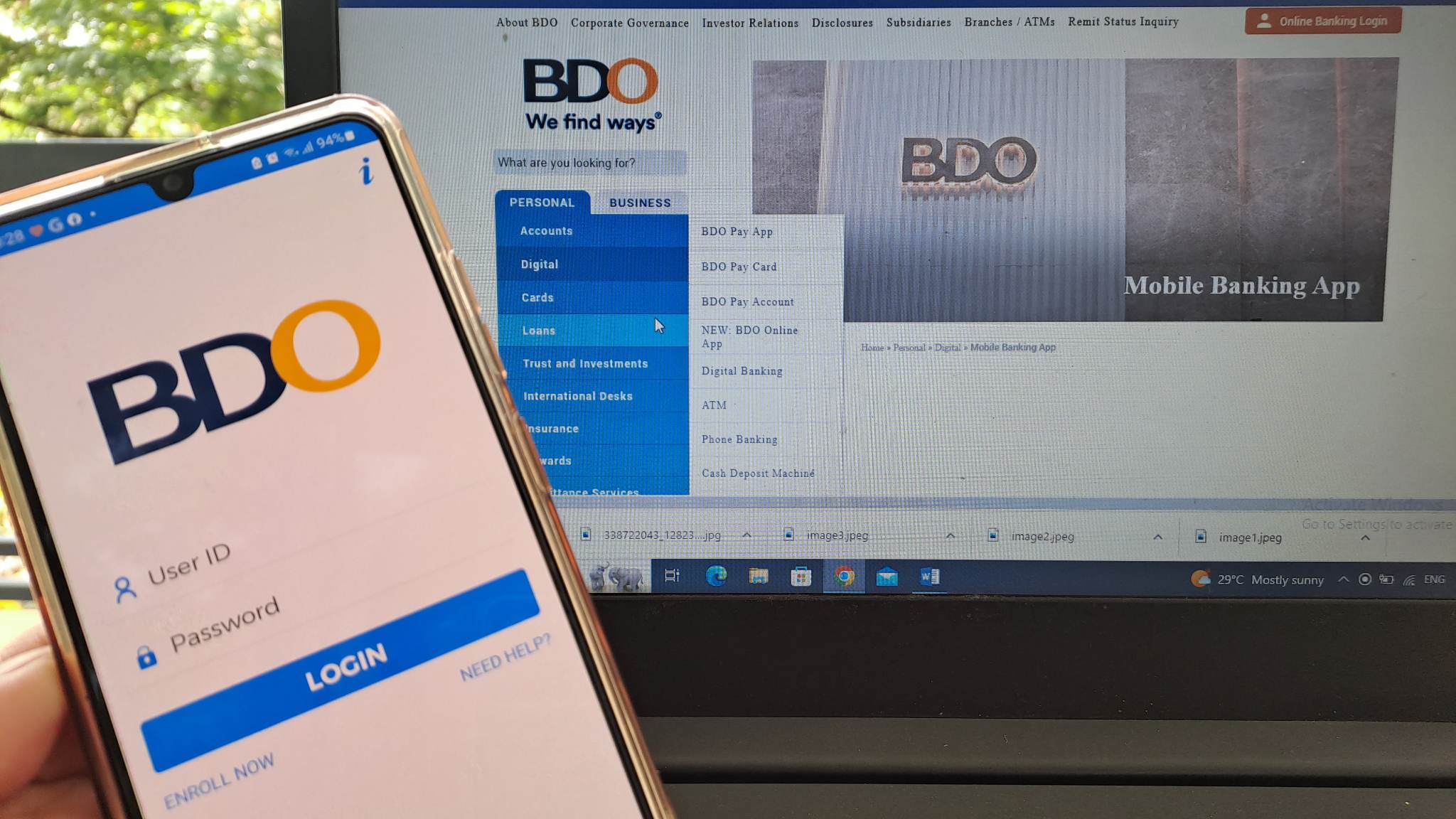

Among several ways that BDO finds to expand its reach to Filipinos like me is through providing us easy access to different financial services in just a few simple clicks. These include transferring of funds, paying my bills, checking the balance of my account, and even applying for loan programs.

Convenient Financial Transactions

Personally, I always find convenience as one of the main factors to be considered when choosing the right bank. It is after all important to choose a bank that provides me enough services and allows me to do my financial transactions without having to go through a lot of process and requirements. This is why I find BDO as a bank that not merely provides efficient online services but also a financing company that truly knows what their clients need.

BDO, in fact, ought to provide a simpler and more convenient manner of transaction unlike other banks or financial institutions that require clients to visit their branch. Through BDO’s official website and online mobile application, I can now do my transaction whenever and wherever I want to.

Easy Access to Loan Programs

Another service that I find BDO efficiently provides is its easy access to funds. In fact, with BDO’s effort to reach Filipino clients, it commits to maximize the use of technology and innovation to provide a high quality and easy financial service.

What seems to be even better with BDO is that everything now works online and while banking can be done from the comfort of your home, so does getting a loan. In fact, whenever I am short of cash to pay my outstanding debts or simply purchase necessary items, it becomes easy to obtain funds as BDO offers quick loan programs.

These programs include Personal Loans where I can borrow cash online to finance my personal needs with less requirements and easy application. This kind of loan may be used for a variety of purposes such as the following:

- Cash Loan

- Home Loan

- Auto or Car Loan

- Gadget or Appliance Loan • Business Loan

- Salary Loan

- Calamity Loan

I find it very helpful especially at times of emergency where I can no longer afford to visit a branch and fall in long lines just to claim cash. Simply put, with BDO online services, it becomes more possible to get instant cash.

With a Broad Financial Service

On top of several loan programs that it offers, BDO moreover provides cash management and bills payment services that are beneficial for individuals like me who wish to save funds and/or settle their bills online. These additional programs widen the range of financial services that BDO offers which, in turn, becomes helpful in managing my funds. It also helps in preventing myself from earning a penalty for paying my bills late as with BDO online services, I can now settle my bills in just a few simple clicks.

With all that, embracing the importance of innovation and digital transformation, BDO has utilized technology to deliver its quality service and broaden its reach to Filipino consumers like me. It provides accessible and user-friendly banking services to ensure that wherever I am, all of my transactions will materialize.

BDO further commits to providing its clients online banking services that are both beneficial and efficient for Filipinos who have less or no time at all to process walk-in transactions. In fact, if you are an entrepreneur who wants to establish a business or an ordinary client who has no chance to visit a bank’s branch, BDO is certainly your go-to bank. After all, with BDO’s mobile app and online banking, you will no longer have to fall in line and exhaust your day as the solution for your financial concerns is now just a few clicks away.