When I first started thinking about investing, I felt a little intimidated. The thought of growing my money through investments such as stocks and the like seemed like a concept that’s reserved for financial experts, or at least for those who had significant amounts to invest upfront. But then I discovered Maya’s investment features and suddenly, investing didn’t seem so out of reach anymore.

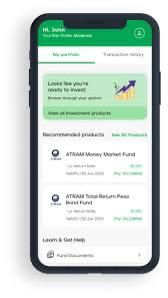

With Maya, I’ve been able to start small—really small. I began with just ₱50 using Maya Funds, choosing from a mix of 13 local and global funds. The flexibility and ease of starting with such a small amount gave me the confidence to dive in. It felt empowering to know that even with a modest budget, I could make smart investment choices and grow my portfolio at my own pace.

One of the best things about Maya is that you don’t need to be a financial expert to get started. Their tools are user-friendly, so even someone like me—who’s more into lifestyle than stock trading—can easily manage investments. Over time, I’ve gradually built up my investments by allocating a little bit here and there whenever I can. Now, I look forward to checking my app and seeing how my funds are progressing.

Here are some practical tips that helped me grow my portfolio:

- Start with what you’re comfortable with: Don’t worry about going big right away. I started with just ₱50, and over time, I added more as I got more confident. As for me, I was really quite curious with all the hype surrounding crypto currencies and I easily made a few extra pesos by putting in as low asPhp 500 into my crypto account.

- Diversify your investments: Maya Funds makes it easy to choose from a variety of local and global options. I invested in different funds to spread my risks and maximize potential gains.

- Consistency is key: Whenever I have a little extra cash, I invest it. Maya makes it so easy to top up, even if it’s just a small amount. Those little contributions add up over time. Investing (safely, with a trusted digital bank, Like Maya!) is a great way to make a little extra. Just this year, I challenged myself to increase the percentage of my personal savings and adding a little bit more to my baby investments can help me reach that goal.

- Explore Maya Stocks: When I felt ready to dive into stocks, I used Maya Stocks to invest in top Philippine companies. It’s all conveniently in-app, which means I can track my progress anytime I want.

Investing doesn’t have to be scary or complicated. Maya has made it possible for me to grow my investments at my own pace, one step at a time. Whether you’re new to investing or already a seasoned pro, Maya’s got tools that can help you get where you want to be. So, why not start today? Use my code “LARIZALOVESMAYA” and create a Maya account today!